The rapid evolution of the blockchain and cryptocurrency landscapes has ushered in a new era of financial technology. Among the most promising innovations is the concept of decentralized exchanges, or DEXs, which operate without a central authority, allowing users to trade directly with one another. Lighter DEX stands at the forefront of this revolution, offering a streamlined and user-friendly platform that aims to enhance the trading experience in the decentralized finance (DeFi) ecosystem. This article will explore the features, benefits, challenges, and future prospects of Lighter DEX, delving into how it is shaping the future of decentralized trading.

Overview

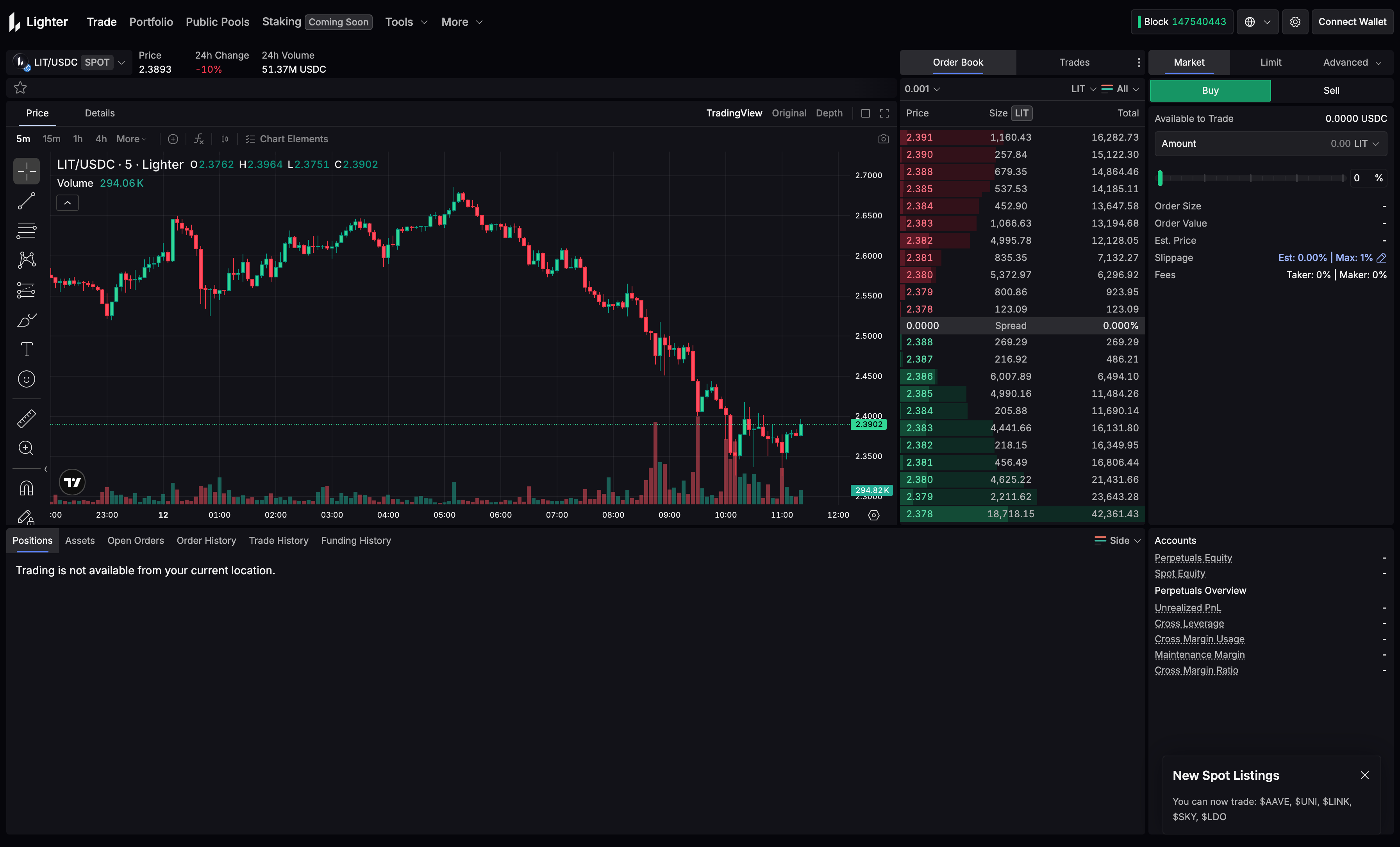

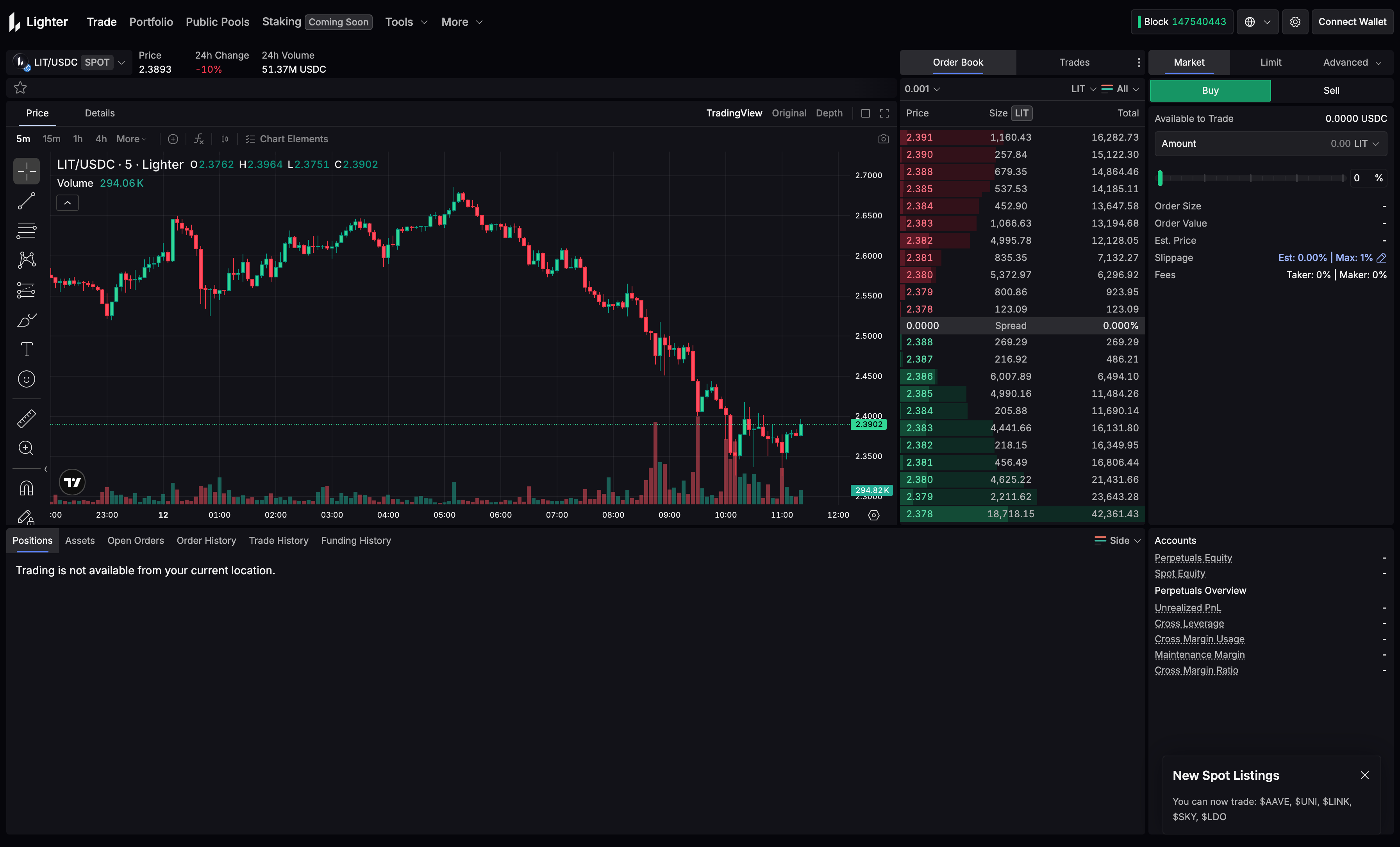

Lighter DEX is a decentralized exchange built on blockchain technology, specifically designed to facilitate peer-to-peer trading of cryptocurrency and digital assets. By eliminating the need for intermediaries and custodial services, Lighter DEX empowers users to retain control over their funds and conduct transactions in a transparent and secure environment. The platform leverages smart contracts to automate trading processes while ensuring enhanced security and minimizing risks associated with centralized exchanges.

Core Mission

The core mission of Lighter DEX is to democratize access to financial markets by providing an intuitive and efficient trading platform for users all over the world. The primary objectives of Lighter DEX include:

1.User Empowerment: Enabling traders to maintain full control over their funds at all times.

2.Enhanced Security: Offering a secure trading environment that mitigates risks associated with hacks and fraud.

3.Accessibility: Making trading more accessible to a global audience, regardless of geographical or financial barriers.

4.Innovation: Continuously evolving the platform to include new features and tools that enhance the user experience.

1. Decentralized Trading Mechanism

At the heart of Lighter DEX is its decentralized trading mechanism, which allows users to trade directly with one another through smart contracts. This approach eliminates the need for a centralized clearinghouse and reduces counterparty risks, ensuring that trades are executed in a trustless environment.

2. Automated Market Making (AMM)

Lighter DEX employs an Automated Market Maker (AMM) model, which enables users to provide liquidity by depositing their assets into liquidity pools. This liquidity is then used to facilitate trades, with users earning fees in return for their contributions. The AMM model ensures continuous trading opportunities and minimizes slippage.

3. User-Friendly Interface

Recognizing the importance of user experience, Lighter DEX is equipped with a simple and intuitive interface that caters to both novice and experienced traders. The platform provides easy navigation, real-time market data, and straightforward trading processes, making it accessible for users of all skill levels.

4. Liquidity Pools and Staking

Lighter DEX allows users to create liquidity pools, where they can deposit assets in exchange for liquidity provider (LP) tokens. Users can stake these tokens to earn rewards, creating a dual opportunity for income generation—through trading fees and staking rewards.

5. Cross-Chain Compatibility

In a diverse cryptocurrency ecosystem, cross-chain compatibility is crucial. Lighter DEX facilitates trading across multiple blockchain networks, allowing users to access various assets and liquidity sources without being confined to a single blockchain.

6. Security Measures

Lighter DEX prioritizes security through rigorous measures, including smart contract audits, two-factor authentication (2FA), and automated alerts for suspicious activities. These protocols ensure that users can trade with confidence and that their funds are protected.

7. Governance Model

Lighter DEX incorporates a decentralized governance model, enabling users to participate in decision-making processes that affect the platform's future. Token holders can vote on proposals, protocol upgrades, and feature implementations, fostering a sense of community involvement.

8. Educational Resources

Recognizing that knowledge is key to successful trading, Lighter DEX provides users with a range of educational resources. Tutorials, webinars, and market analysis are available to help users improve their trading skills and understanding of decentralized finance.

1. Full Control of Assets

One of the primary advantages of Lighter DEX is that users retain full control over their funds at all times. Unlike centralized exchanges, which require users to deposit assets, Lighter DEX allows users to trade directly from their wallets, minimizing the risks associated with third-party custody.

2. Lower Fees

Lighter DEX typically offers lower trading fees compared to traditional exchanges. The absence of a centralized authority and middlemen translates to reduced costs, benefiting traders and liquidity providers alike.

3. Enhanced Privacy and Anonymity

Trading on Lighter DEX allows users to maintain a higher level of privacy and anonymity. There is no need to provide personal information or undergo KYC (Know Your Customer) procedures, which can be a barrier on centralized platforms.

4. Global Accessibility

Lighter DEX is accessible to users around the globe, enabling participation from individuals who may not have access to traditional financial services. This inclusivity promotes financial equality and empowers unbanked populations to engage in trading.

5. Community-Driven Development

The governance model of Lighter DEX emphasizes community involvement in decision-making. Users can propose and vote on changes to the platform, ensuring that it evolves in line with the needs of its user base.

6. Potential for High Returns

By participating as a liquidity provider or engaging in trading activities, users have the opportunity to earn rewards and fees. The potential for high returns attracts both retail and institutional investors seeking to capitalize on the DeFi trend.

1. Retail Trading

Lighter DEX caters to retail traders seeking an efficient and secure platform to exchange cryptocurrencies. The user-friendly interface, combined with low fees and the ability to retain asset control, makes it an appealing option for individuals looking to trade.

2. Liquidity Provision

Liquidity providers play a vital role in Lighter DEX’s ecosystem. By contributing funds to liquidity pools, they facilitate trading for others while earning fees for their contributions. This active participation strengthens the overall liquidity of the platform.

3. Cross-Chain Arbitrage

Lighter DEX’s cross-chain compatibility allows traders to engage in arbitrage opportunities. Users can take advantage of price discrepancies across different blockchains, enhancing potential profit margins and trading strategies.

4. Yield Farming

With the staking options available on Lighter DEX, users can engage in yield farming, where they lock up their assets in liquidity pools to earn passive income. This practice has become increasingly popular in the DeFi space and provides additional earning opportunities.

5. Institutional Participation

As the DeFi ecosystem matures, Lighter DEX presents a viable option for institutional investors seeking exposure to decentralized trading. The platform’s security measures and governance model can attract institutional capital while maintaining compliance with regulatory standards.

1. Market Competition

The DEX landscape is highly competitive, with numerous platforms vying for user attention. Lighter DEX must continuously innovate and differentiate itself to attract new users and retain its existing customer base.

2. Liquidity Issues

Achieving sufficient liquidity is crucial for the success of any DEX. Lighter DEX may face challenges in attracting liquidity providers, particularly during periods of market volatility or competition from other platforms.

3. Regulatory Uncertainty

As the regulatory landscape for cryptocurrencies evolves, DEX platforms may face scrutiny from regulators. Compliance with existing laws and adapting to new regulations will be essential for Lighter DEX to operate smoothly.

4. Smart Contract Vulnerabilities

While blockchain technology offers security, vulnerabilities in smart contracts can pose risks. Lighter DEX must conduct thorough audits and maintain ongoing security assessments to minimize the potential for exploits.

5. User Education

Despite the platform’s user-friendly design, there may be a learning curve for new users unfamiliar with DEXs. Lighter DEX needs to continue investing in education and resources to empower users and enhance their trading skills.

1. Feature Expansion

Lighter DEX is likely to continue expanding its feature set to meet user demands and industry trends. Future developments may include advanced trading tools, automated trading options, and enhanced analytics.

2. Cross-Platform Collaboration

The future may see Lighter DEX forging partnerships with other DeFi projects, aggregators, and liquidity protocols to enhance its offerings and provide users with a more comprehensive trading ecosystem.

3. Institutional Adoption

As institutional interest in DeFi grows, Lighter DEX could focus on attracting institutional investors through tailored solutions and compliance measures. The ability to offer institutional-grade services can position Lighter DEX favorably within the market.

4. Enhanced Security Protocols

Continued advancements in security protocols will be essential for maintaining user trust. Lighter DEX may explore innovative security measures, such as multi-signature wallets and decentralized insurance options, to protect user assets.

5. Global Outreach

With a focus on promoting financial inclusion, Lighter DEX could invest in international marketing strategies to reach underserved populations and emerging markets. By expanding its user base, the platform can enhance liquidity and overall growth.

Lighter DEX stands as a transformative force in the decentralized finance space, providing users with a secure, efficient, and user-friendly platform for trading and interacting with digital assets. By embracing the principles of decentralization, transparency, and community involvement, Lighter DEX addresses many of the challenges faced by traditional exchanges.

As it continues to evolve, Lighter DEX holds the potential to reshape how individuals and institutions engage with financial markets, promoting financial sovereignty and accessibility. While challenges exist in the competitive landscape, the platform’s commitment to innovation and user empowerment positions it as a key player in the future of decentralized trading.

With the increasing adoption of DeFi, Lighter DEX is not just another trading platform; it represents a new paradigm in how we think about finance. As users navigate this exciting frontier, Lighter DEX aims to be their trusted partner, guiding them toward a brighter, decentralized financial future.

AI Website Maker